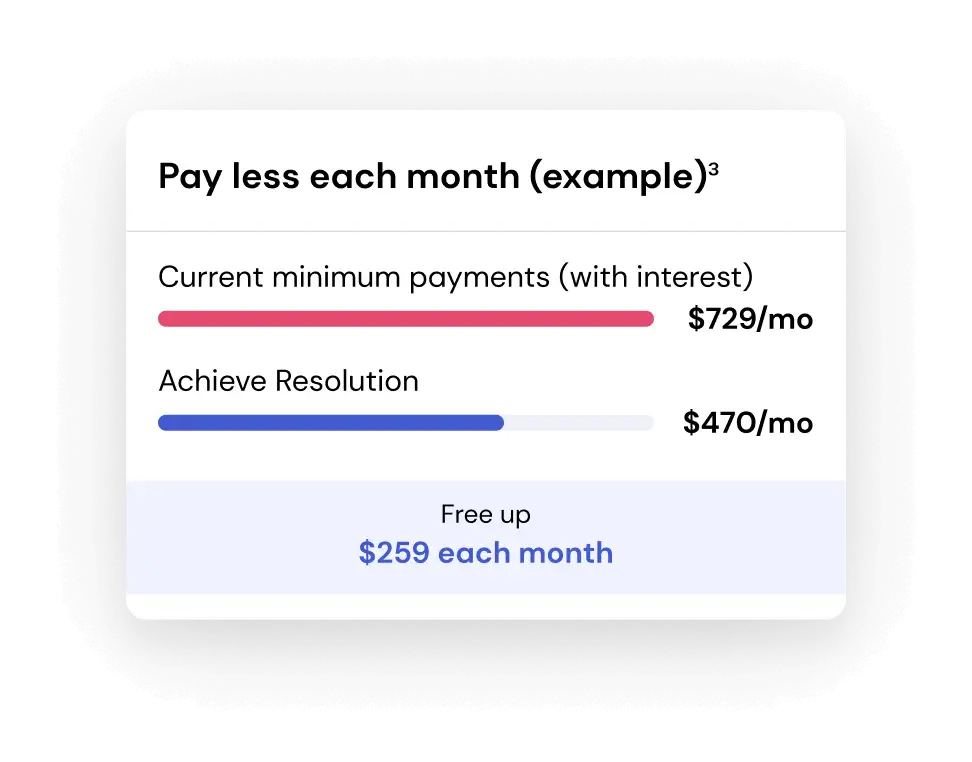

Paga menos con el apoyo de nuestro equipo de expertos.

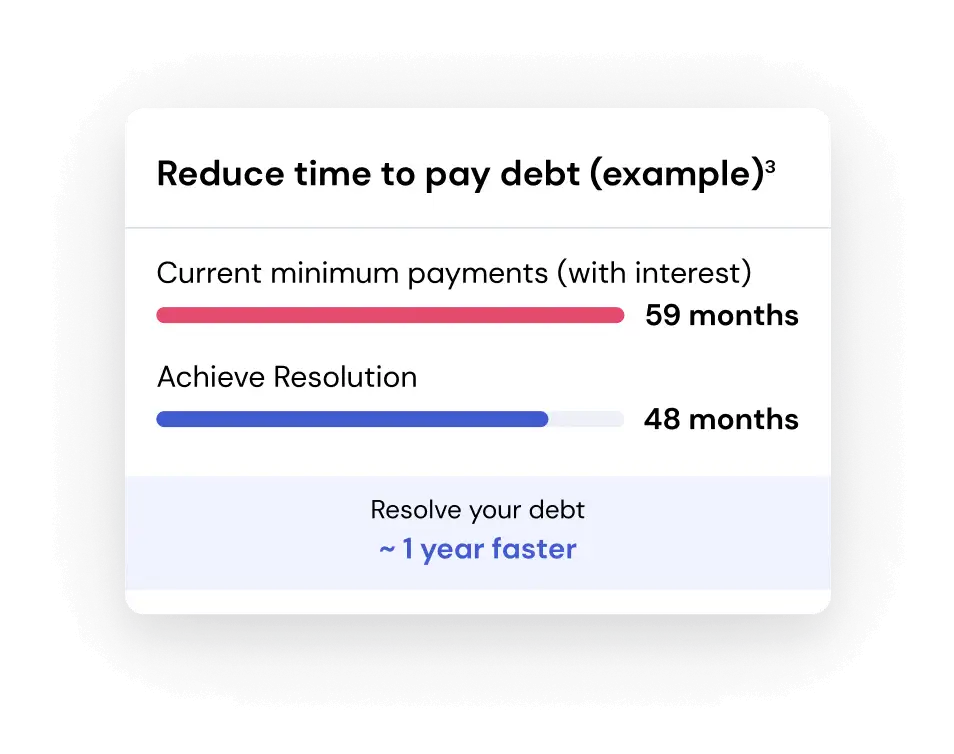

Deja atrás tus deudas en 24-48 meses con nuestra ayuda.

Simplifica tus deudas en un solo pago manejable con nuestro programa.

Confía en nuestros expertos para negociar con tus acreedores y reducir tus deudas.

Aún puedes recibir ayuda con tus deudas, sin importar tu puntaje.

Toma el control de tus finanzas sin necesidad de un préstamo de consolidación.

Our skilled negotiators collaborate with creditors to help you eliminate debt in just 24-48 months!

If you’re facing unmanageable debt and need support, the Resolve-Debt team is ready to assist you.»

Our team of debt consultants, debt negotiators, and Member Services Representatives have served more than 1 million members over 20+ years.

4.5/5

Working with ResolveOne was a game-changer for me. Their team helped me reduce my debt faster than I thought possible, and I finally feel in control of my finances!

— Emily S.

Marketing Specialist

4.5/5

The experts at ResolveOne truly care about their clients. They negotiated with my creditors and helped me save thousands. I highly recommend them!

— Sarah L.

Debt Negotiation Client

4.5/5

I was overwhelmed by my credit card bills, but ResolveOne guided me every step of the way. I couldn’t believe how much easier they made the process!

— James T.

Resolve-Debt

4.5/5

I never thought I could overcome my debt, but ResolveOne made it possible. Their team provided the support I needed, and now I’m on the path to financial freedom!

— Michael R.

Financial Recovery Client

Join the 60% who settle their debt within just three months!

Your program is designed to help you succeed.

Here for you 7 days/week via phone & 24/7 with your online dashboard.

Introduction Navigating through financial hardships can be daunting, especially when debts start to pile up.

Managing debt is a crucial aspect of financial health, yet many individuals make mistakes that

When struggling with debt, finding a path to financial stability can feel overwhelming. Working with

In times of financial distress, it’s crucial to have a partner who not only understands

Customize your loan

Pay debt with equity

Explore your best solution

Understanding your options is essential, and each solution has its own benefits. Here’s a quick overview to help you navigate your choices:

Credit Counseling:

This option is designed to help you learn effective budgeting skills and curb overspending. Counselors can enroll you in a debt management plan, which typically lowers your interest rates and sets up a manageable payment schedule. This makes repaying your debt simpler and more affordable. However, keep in mind that credit counselors will control your funds and decide how your money is distributed to creditors.

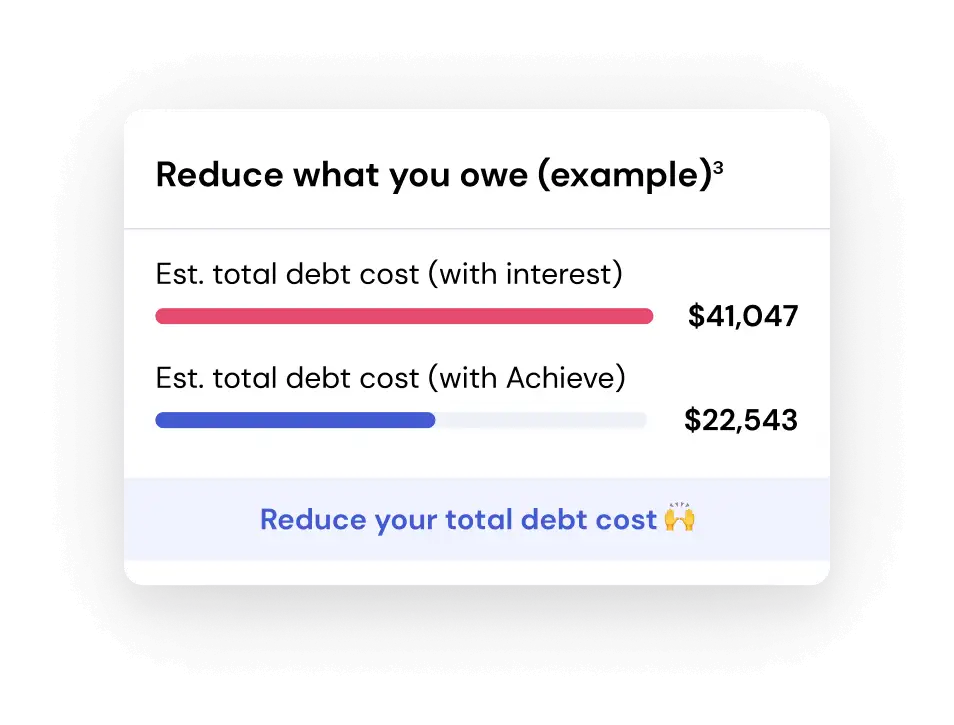

Debt Resolution:

With debt resolution, our goal is to negotiate with your creditors to accept less than you owe as full payment. This can be particularly helpful if you’re struggling to pay off the entire amount. A key advantage of using Resolve-Debt is that you retain control—everything we do must be approved by you, ensuring your preferences guide the process. Unlike credit counseling, we don’t manage your money; you decide how it’s distributed to creditors.

Bankruptcy:

This is a court-ordered plan where you either surrender some assets or pay into a plan to discharge a portion of your debts. While it can provide a fresh start, bankruptcy has long-term implications and should be considered carefully.

If you have any questions or need further assistance, we’re here to help you find the best solution for your financial situation!

At ResolveOne Financial, we specialize in helping you tackle unsecured debt—debt that isn’t backed by collateral like a car or house. Here’s a breakdown of the types of debt we can assist you with:

Debts We Can Help With:

Debts We Can’t Help With:

If you’re unsure about your specific situation, feel free to reach out. We’re here to help you navigate your debt and find the best solution!

At ResolveOne Financial, our Achieve Resolution program is designed with you at the center of everything we do. We’re committed to ensuring that our solution is the right fit for your unique needs and circumstances. Here are the key benefits you can expect:

1. Informed Decisions:

You’ll receive a free debt evaluation to help you understand your options and make informed choices.

2. Personalized Success:

Our personalized financial assessment includes a cash flow analysis to set you up for success and guide your financial journey.

3. Clear Communication:

We prioritize transparency, so you won’t encounter surprises. We provide clear terms and keep you informed every step of the way.

4. Program Guarantee:

Our Program Guarantee ensures that if your total program settlement cost exceeds the total amount of debt you enrolled in, we’ll refund the difference—up to 100% of our collected fees.*

5. Legal Support:

We partner with a network of attorneys specializing in debt negotiation. The cost of this Legal Plan is included in your program, available to you as long as you make your deposits on time.

6. 24/7 Access to Resources:

Resolveone Financial offers complimentary tools and guidance to support your success. You’ll have access to an online dashboard where you can chat with Member Services seven days a week, along with various videos and articles to enhance your financial skills.

*Note: For the settlement fee refund, “ResolveOne Financial program settlement costs” refer to (a) the total amount you paid to creditors through the program and (b) the total settlement fees paid to us (excluding other fees or taxes). Any new debt incurred after enrollment won’t qualify for this refund.

If you have any questions or need further assistance, we’re here to help you every step of the way!